Olivier Le Moal

Strong inverted differences between the short-end of the yield curve and the longer-end helped fuel strong cash performance for AGNC (NASDAQ:AGNC). These conditions, expected to continue for some time, offer AGNC, thus investors, a unique investing opportunity when timed properly. With a Fed seeming closer to ending the interest rate rout, investors might begin paying more attention to this opportunity. The strong currents, driving low asset prices and high cash flows, can't last forever, but they might last longer than our imagination thinks.

Quarterly Results

The company reported strong cash flow while maintaining its hedge against future volatility. The results included:

- Leverage of 7.2 times tangible equity, down from 7.4 times in the previous quarter.

- "Affected by reductions in our asset balance and the addition of $171 million of common equity."

- Cash and unencumbered Agency MBS totaling $4.1 billion or 57% of the tangible equity.

- Net spread and dollar roll income excluding catch-up amortization of $0.70 per share down $0.04 quarter over quarter.

- The slightly lower dollar roll was driven by higher funding costs and the addition of new longer-term fixed swaps.

- Hedges dropped to 114% at quarter's end, but at the time of the call were under 100%.

- An average projected life (CPR) at the quarter's end of 10%.

- Affected by moderately lower forward mortgage rates and a higher average coupon in the portfolio.

- Actual CPRs for the quarter declined to 5.2%.

A slide from the presentation showing important changes including: average asset yield, average cost of funds, net interest spread and income per share, follows.

AGNC

Notice the two charts on the left, with its history of significant increased spreads and a high dollar roll (cash) result, almost double of the quarterly dividend paid monthly at $0.36.

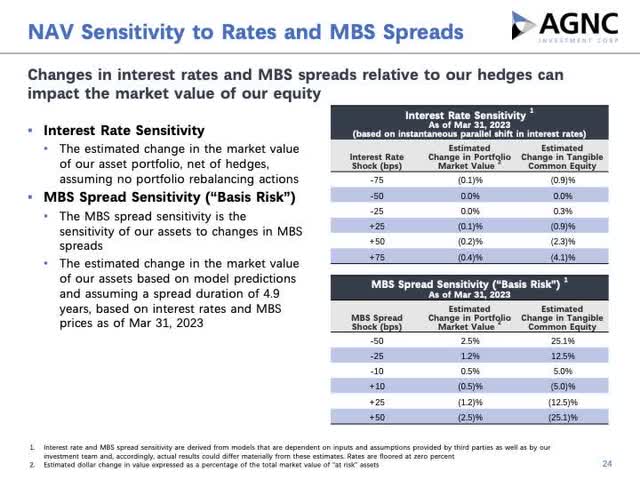

The next slide reminds investors of the stock asset value sensitivity.

AGNC 1st Quarter Presentation

The major change in net asset value comes with MBS Spread changes shown in the lower right portion of the chart. MBS increases decrease the value and vice versa. Also, it is critical to remember that cash generation works in reverse opening the door for unprecedented investment opportunities.

Management's Marketplace Commentary

Next we add color from management about what it sees in the marketplace. Management noted:

"In this highly uncertain environment, interest rate volatility increased to crisis levels. As an example, the MOVE index, which measures treasury market volatility, reached a 15-year high. . . .Short-term interest rates experienced the greatest volatility, with the yield on the 2-year treasury dropping 61 basis points in a single day, unmatched by any day during the great financial crisis. Longer-term treasury rates were also volatile with the yield on the 10-year treasury increasing 60 basis points in February and falling by a similar amount in March."

In describing the quarter during the prepared remarks, AGNC noted that the first portion of the quarter strengthen net asset value followed by a challenging second half. In the beginning, it appeared that the Fed was headed higher toward 6%. With the banking crisis, that view changed toward rate cuts in the earlier part of March. With at least outward resolution of the banking crisis, views for more rate increases jumped in. For companies like AGNC, different approaches for hedges, leverage and investments are generated with increasing or decreasing expectations. This was a management nightmare.

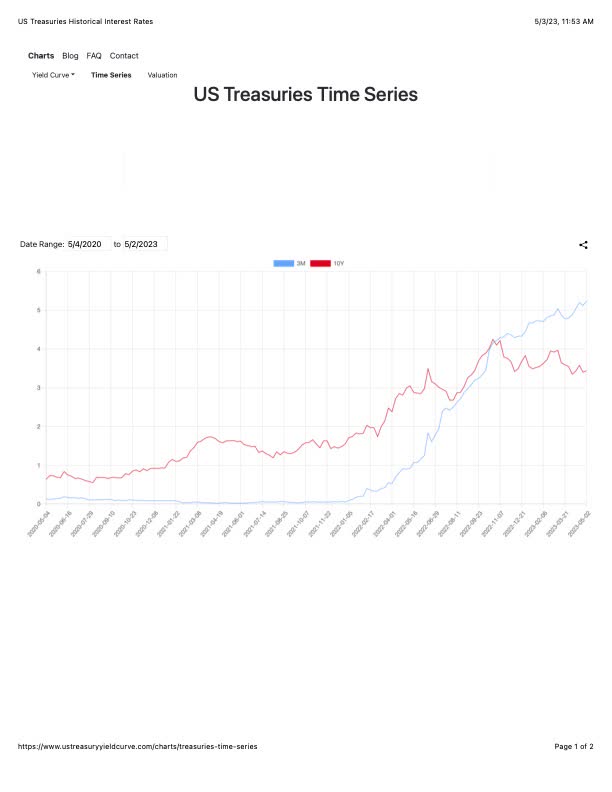

Continuing, a chart showing the steep inverted curve follows illustrating the strength of the opportunity.

Us Treasury Yield Curve

Notice the 10 year rate, in red, went flat while the 3 month, in cyan, continued higher.

Finally, the prepared remarks added this bit of juicy commentary,

"Also important, unlike banks, our interest rate exposure is conservatively hedged and our portfolio is fully mark to market. As such, when you invest in AGNC today, you are buying into a levered and hedged portfolio priced at today's historically attractive valuation levels, making this opportunity very similar to 2009, which was one of AGNC's most favorable periods."

When asked about the purpose for selling some equity, management noted that the intent isn't to increase the size of the company, but rather for cash generation in preparation for the coming direction change toward purchasing assets through increasing leverage and cash.

We noted some detail in this section for investors to more fully understand the unusual volatility in the market. At one moment marketplace interest rate predictions showed falling, the next climbing and so forth. It was a rollercoaster and management head scratcher.

Agency MBS Spreads: The Fuel

Management, once again, highlighted the importance for the Agency MBS spreads making clear that these are the fuel driving both the marketplace and AGNC's model. From the prepared remarks, "Agency MBS have been uniquely impacted with the spread between the current coupon MBS and the 10-year treasury, widening 135 basis points since April 2021." Management continued that their experience leads them to believe that wide spreads could remain long after the tightening cycle is behind us. Continuing, "Such spread levels provide investors with meaningful incremental return and are about double the average of the last 10 years." For investors, this suggests the AGNC's portfolio would continue to generate mid-teen returns.

Adding more fuel into the fire, Peter Federico, CEO, answered in quite a lengthy discussion a question from Bose George of KWB about treasury spreads vs. mortgage spreads ending with this comment,

"So, think about it, if you're looking at the 10-year treasury at 3.5% and you can earn 5.25% for the same credit quality for a duration that's actually shorter than a 10 year, I think that's really compelling."

The fuel driving the bonfire comes with a natural element of similar credit quality to what many consider safe investments, treasuries, but at significantly higher returns.

A Directional Change Approaches

What was clear is AGNC plans to begin repurchasing primarily Agency MBS and lever the balance sheet. From their thinking, the Federal Reserve will in the worst-case pause and most likely leave flat or cut rates later this year. The Fed did signal a pause after AGNC's conference.

The company's preparation includes:

- Lowering Agency MBS portfolio to $56.8 billion to lower leverage.

- Raise cash through an equity sell.

- Lowered its TBA position.

With respect to hedging, the company begin its climb into longer dated hedges mainly in the intermediate term while holding on to short long-term positions. This action de-risks steeper curves. (This stems from a management belief that the Fed has stopped increases and might even be forced to lower the rates.)

Inherit, in these actions, is management's view that the Fed understands its increases has created a natural barrier for bank loans in that it left bank assets used for these loans, crippled, an inverse from previous interest rate increase scenarios.

The Setup & Dividends

A back look at the company's position in two critical factors, cash on hand and leverage, offers investors a window of understanding for what might happen.

| Balances | March 23 | Dec. 22 | Dec. 21 | Dec. 20 | Dec. 19 | Dec. 18 |

| Cash | $4.1 | $4.3 | $4.9 | $5.4 | $0.8 | $0.9 |

| Leverage | 7.2 | 7.4 | 7.7 | 8.5 | 9.4 | 9.0 |

From 18 to today, the company has ranged its leverage 30% and increased its cash by several billion. Over the next few years, AGNC might increase its cash generating assets in the 20% - 30% range which offers an opportunity for increasing dividends by at least that much or perhaps more. It should also be noted that a steepening curve also increases the company's NAV from which the stock price will follow higher, significantly higher. The question becomes, when?

Risks

Perhaps, the greatest risk for management is crazy volatility in the interest rate markets. AGNC's model requires hedging and management of leverage. Thus far, the company believes that the Fed is finished. It might not be leaving their position on the wrong side. One opinion, referenced above, Bill Winters told CNBC, "So, if we can get the regular wage growth cycle back under control, then I think the Fed can stop here. But it's not done yet." Wages in the U.S. and Europe are still hot according to Winters. If management misses the Fed direction, at least some additional risks, is now in play. We noticed that management made clear that its movements are measured not frantic. Another risk might be within the company's short 10 yr. bond holdings when rates could head higher. It is also clear that this rate went flat making its short position less risky.

There is risk in owning AGNC mainly from the gyrations in the interest rate environment caused most recently from banking instability. But the company holds premium MBS positions and remains heavily hedged in a strong cash generating environment. With this in mind, we continue to hold our position and slowly add. We rate the stock a hold or measured add.

"lasting" - Google News

May 12, 2023 at 12:09AM

https://ift.tt/IMatLgo

Strong And Lasting Differentials Support AGNC's Strong Cash Performance (NASDAQ:AGNC) - Seeking Alpha

"lasting" - Google News

https://ift.tt/cR94WKa

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Strong And Lasting Differentials Support AGNC's Strong Cash Performance (NASDAQ:AGNC) - Seeking Alpha"

Post a Comment