Both economists and policymakers have highlighted the danger that the short-term measures taken to limit the spread of Covid-19 could lead to lasting economic damage. This column identifies and discusses five conceptually separate channels that could lead to such ‘scarring’ and attempts a very rough quantification of the potential impacts in both the short to medium term and longer term. Policy will eventually need to ‘pivot’ from helping firms survive and preserving jobs to helping workers into new jobs.

From the beginning of the Covid-19 crisis, economists have been remarkably united on what policymakers should and should not worry about from an economic perspective. The very sharp fall in GDP resulting from health-related restrictions, as well as individuals’ own decisions, is not the main concern – indeed, it is necessary to suppress the virus and therefore allow economic recovery. Rather it is to prevent permanent damage to the economy, often referred to as ‘scarring’. “The key is to reduce the accumulation of ‘economic scar tissue’” (Baldwin and Weder di Mauro 2020).

The term ‘scarring’ – which seems to have replaced ‘hysteresis’ among economists as well as the general public – has appeared 32 times in the Financial Times since the beginning of the crisis; in the previous year it appeared only a handful of times in the economic sense. But it is a catch-all term, referring to a number of quite different ways in which transitory economic conditions can negatively affect the long-run level or growth of output. In thinking about policies, both now and as countries emerge from lockdown, it is helpful to distinguish between these potential channels and to assess their relative importance. In this column I present a (non-exhaustive) list, as well as some very tentative quantifications.

- Unemployment. The Covid-19 restrictions – shutting down major sectors of the economy – mean large numbers of workers (20-30% of the workforce in many countries) have been unable to work. In the US, this has manifested itself in unemployment; in most European countries, ‘furlough’ schemes of various sorts have limited open unemployment. The potential medium- to long-term impact of mass unemployment is the most obvious form of scarring resulting from a ‘traditional’ demand deficiency recession. It refers to the potential adverse impact of short-term unemployment on future labour market prospects, via human capital depreciation. When people are unemployed, their skills may atrophy, their labour market attachment may diminish, and – given the well-known association between unemployment and wellbeing – their mental health may suffer. All of these reduce their future employment and wage prospects. The quantitative impacts are significant – typical estimates are of a lasting wage penalty of 8-10% and an employment penalty of 6-9% (Arulampalam et al. 2003, Tumino 2015), relative to workers with similar characteristics. The impacts are particularly severe for young people, and the impacts increase non-linearly with the length of unemployment.

- Loss of job-matching capital. Conceptually separate from the damage to individuals’ human capital from unemployment is the economic loss resulting from job separation itself. To the extent that workers and firms have accumulated job-specific capital – that is, that the worker is more productive in her specific job than in an alternative one – job loss will destroy that capital and reduce her future earnings as well as, possibly, the productivity of the firm (if it survives). Empirically it is difficult to separate out the impacts of job separation and subsequent unemployment, although the impacts of separation itself would be expected to be more transient. Quintanna and Venn (2013) find that “displaced workers in the Nordic countries experience relatively small falls in earnings, while those in Germany, Portugal and the United Kingdom have losses of 30-50% in the year of displacement and the United States is somewhere in between.”

- Firm-specific capital. Demmou et al (2020) suggest that two months of restrictions would mean approximately 30% of European firms would face severe liquidity problems. A firm is a collection of business processes and relationships (legal, personal and otherwise, both within the firm and beyond it). In ‘normal’ times, firm creation and destruction are a source of productivity growth, as less efficient firms However, the nature of the Covid-19 shock means that large numbers of ‘viable’ firms are under threat. These constitute a form of intangible capital that is largely or wholly dissipated when the firm is dissolved. Some of this is reflected in job-specific capital, but beyond that there are broader concepts of ‘organisational capital’. Lev and Radhakrishnan (2003) estimate that such capital is worth, on average, about 3% of turnover (note that total business turnover is about 200% of GDP in the UK).

- Education. In most developed countries, schools have closed for extended periods. Since the purpose of schools is primarily to educate pupils, it would be surprising if this did not lead to a diminution in the acquisition of human capital: “Even a relatively short period of missed school will have consequences for skill growth” (Burgess and Sievertson 2020). If the return to an additional year of education is approximately 8-10%, and the average student misses one quarter of the school year, then one might estimate a permanent impact on earnings of 2% to 2.5%.

- Business investment. There are relatively few data about the impact of the pandemic on business investment, but it will obviously fall sharply during the period of restrictions and will likely remain very weak for a period, given uncertainty about economic prospects in the short to medium term. Private sector gross domestic fixed capital formation in G7 countries ranges from about 14% to about 18% (Office of National Statistics 2017). If the impact of the pandemic is to halve private investment for a year, that would reduce investment by about 7% to 9% of annual GDP. This in turn will reduce future potential output – if the incremental capital-output ratio is about 10, by up to 1% of GDP.

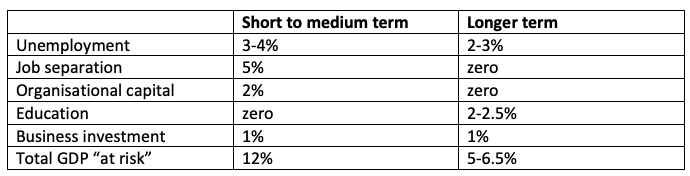

In Table 1, I present rough estimates of the potential impact on GDP of these various ‘scarring’ effects. There are obvious differences in the time profile – the impact of lost education will only be felt after some years, while the impact of the destruction of firm-specific capital will fade out – so I present estimates for both the short to medium term (say, 1-2 years) and the long term (5 years and beyond). It goes without saying that these are subject to multiple forms of uncertainty; apart from the robustness, rigour or representativeness of the historical estimates on which they are based, Covid-19 is an unprecedented form of economic shock. Nevertheless, they are potentially useful in giving a sense of potential magnitudes and – critically for policymakers – which impacts are likely to be the most damaging.

Table 1

Source: author’s calculations

What conclusions can we draw from this very rough and ready attempt to quantify the magnitude of potential impacts? Three stand out:

- Economists’ concern about scarring is entirely justified. The magnitude of these potential impacts is huge – and dwarfs the short-term costs of the restrictions.

- The fact that there are numerous conceptually separate channels – and this is by no means an exhaustive list – is often obscured in the public debate, and makes policymaking much more complex. “Doing whatever it takes” is an excellent starting point, but we will need to do it across multiple policy dimensions.

- Some of the impacts will fade out over time, but others will be persistent. While the natural resilience of market economies will significantly attenuate the damage, there is no theoretical or empirical reason to believe that it will ever repair it entirely. Aggressive policy actions are essential.

However, such actions need to be carefully designed, and the optimal policies will likely vary over time. In the short to medium term, the negative impacts of job separations and business failures dominate, so action – like furlough schemes – to keep firms in business and keep workers employed in their current jobs is justified. But over the longer term, the main channels are individual-specific human capital. At some point the focus needs to switch to active labour market policies – including subsidies to facilitate retraining and labour reallocation – and education (Portes and Wilson 2020).

Finally, the scarring channels described here are primarily microeconomic, in their conception if not necessarily their impacts. I have not dealt with the potential impact of debt overhangs, public or private, or the potential impact of a prolonged period of depressed demand on growth and productivity, although the aftermath of the global financial crisis suggests this may also be a further risk. Aggressively expansionary macroeconomic policies are likely to be both necessary and broadly complementary to the policies I suggest here (e.g. Cerra et al 2020).

References

Arulampalam, W, P Gregg and M Gregory (2001), “Unemployment Scarring", The Economic Journal 111(475): F577-F584

Baldwin, R and B Weder di Mauro, B, (2020), Mitigating the Covid Economic Crisis: Act Fast and Do Whatever It Takes, a Voxeu.org eBook, CEPR Press.

Burgess, S and H Sievertson (2020), “Schools, Skills and Learning: the impact of Covid-19 on education”, VoxEU.org, 1 April.

Cerra, V, A Fatás and S Saxena (2020), “The persistence of a COVID-induced global recession”, VoxEU.org, 14 May.

Demmou, D, G Franco, S Calligaris and D Dlugosch (2020), “Corporate sector vulnerabilities during the COVID-19 outbreak: Assessment and policy responses”, VoxEU.org, 23 May.

Lev, B and S Radhakrishnan (2003) “The measurement of firm specific organisational capital”, NBER Working Paper 9581.

Office of National Statistics (2017), “An international comparison of gross fixed capital formation”, 2 November.

Portes, J and T Wilson (2020), “We need an exit strategy for jobs”, Prospect Magazine, 4 May.

Quintini, G and D Venn (2013), “Back to Work: Re-employment, Earnings and Skill Use after Job Displacement”, OECD, October.

Tumino, A (2015), “The scarring effect of unemployment from the early ‘90s to the Great Recession”, Institute for Economic and Social Research Working Paper 2015-5.

"lasting" - Google News

June 01, 2020 at 06:00AM

https://ift.tt/2XiewYW

The lasting scars of the Covid-19 crisis | VOX, CEPR Policy Portal - voxeu.org

"lasting" - Google News

https://ift.tt/2tpNDpA

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "The lasting scars of the Covid-19 crisis | VOX, CEPR Policy Portal - voxeu.org"

Post a Comment