How much will it cost to combat climate change? By some estimates, a staggering $50 trillion. And while this may seem like an impossibly daunting figure, you should know there is a solution to this financing gap: green bonds.

But having only been around for a little over a decade, they are still a relatively unfamiliar investment for many.

The above infographic from IFC explores the exciting world of green bonds, which are gaining serious traction in financial markets.

Green Bonds 101

To begin, green bonds are not that different from regular bonds. Both are debt instruments or fixed income securities that pool capital from investors for a specified project or objective. But while Fortune 500 companies issue bonds to generally enhance their bottom line, green bonds differ in their commitment to eco-friendly ventures and sustainability.

Here’s a closer look at the anatomy of bonds, including green bonds:

- Yield: The fixed coupon rate as a % of the market value of the bond price.

- Maturity: The predetermined length of the bond.

- Credit Rating: The rating bonds receive to determine their riskiness and quality.

- Bond Price: The price of the bond purchase (typically starts out in $1,000 denominations).

- Coupon: The payment on the bond usually occurs in semi-annual or quarterly installments.

Unlike bonds which have been around for centuries, dating back to the Mesopotamian times, green bonds are still relatively new. And in this short time, they have been taking modern finance by storm.

Why Green Bond Offerings Are Accelerating

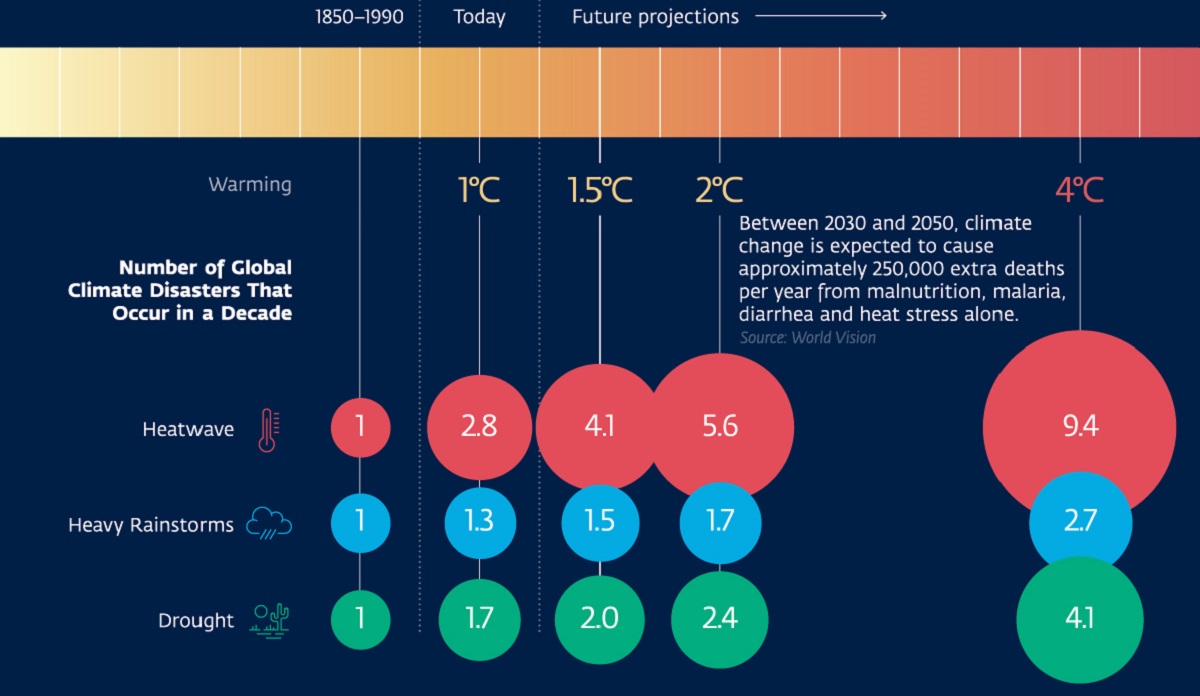

It has become practically impossible to ignore the conversation around climate change. And as of late, there appears to be a newfound sense of urgency due to the acceleration of natural disasters occurring. Thanks to rising global temperatures, infrequent and extreme weather events are becoming more frequent than ever before. For example, when compared to 1850-1900, heat waves occur almost 3x more often today.

Here’s a breakdown of extreme weather event occurrences, based on future projections for global temperature averages:

| Extreme Weather Event | 1850-1900 | 1℃ (Today) | 1.5℃ (Future Projections) | 2℃ (Future Projections) | 4℃ (Future Projections) |

|---|---|---|---|---|---|

| Heatwave | 1 | 2.8 | 4.1 | 5.6 | 9.4 |

| Heavy Rainstorm | 1 | 1.3 | 1.5 | 1.7 | 2.7 |

| Drought | 1 | 1.7 | 2.0 | 2.4 | 4.1 |

Unfortunately, as it stands, global temperature increases show no signs of slowing. That said, these risks can also expedite the growth for the green bond market, especially since they’re a compelling investment.

The Investment Case For Green Bonds

Since 2018, green bonds have been an outperformer relative to the average returns from the global bond universe. With interest rates at near-century lows, and equity valuations at frothier levels, investors may see green bonds as an increasingly attractive route.

In some cases, the yield on green bonds goes upwards of 6%—4 percentage points greater than the 2% yield on 10 Year Treasury. Furthermore, 61% of green bonds are assigned a credit rating of ‘A’ or higher. This is an important feature given that the amount of high quality credit ratings have been capitulating since the 1990s.

Breaking Down Green Bond Issuance

Green bonds make up over half of the ESG investment universe and are being used primarily for transport and energy projects, which make up 35% and 29% of proceeds, respectively. Here’s how their total proceeds break down:

| Type of Green Bond Project | Use of Proceeds (%) |

|---|---|

| Energy | 35% |

| Transport | 29% |

| Water | 11% |

| Building | 9% |

| Waste | 7% |

| Land | 5% |

| Other | 4% |

To add to this, the U.S. represents the largest market by green bonds outstanding, followed by France and China. By currency, however, the Euro represents almost 60% of all green bonds.

Green Bond Growth: A Timeline

In a short time period, green bonds have experienced a rapid ascent into mainstream finance. The table below provides an overview of some of the major milestones achieved:

2010: IFC issues its first green bond through a $200 million private placement and becomes one of the earliest issuers of green bonds.

2010: IFC launches the Green Bond Program to unlock investment in private sector projects in emerging markets.

2013: IFC issues first $1 billion green bond, and then issues a second $1 billion green bond in the same year, helping to catalyze the market.

2014: Total green bond issuance more than triples to $37 billion.

2015: Green bond market hits $100 billion in cumulative issuance.

2017: Green bond market hits $250 billion in cumulative issuance.

2019: In September 2019, IFC crossed the $10 billion threshold in cumulative issuances under its own Green Bond Program.

2020: Green bond market reaches the $1 trillion milestone in cumulative issuance.

2021: As of June 30th, IFC has issued 178 green bonds in 20 currencies amounting to more than $10.5 billion.

In a little over a decade, green bonds have had a monumental rise from a market worth millions to $1 trillion in cumulative issuance.

The Next Decade: Where Do Green Bonds Go From Here?

Although issuance is at record breaking levels, this is still just the beginning. Green bonds have a substantial expected growth trajectory, especially when considering that the regular bond market is worth $128 trillion.

Climate change is often touted as humanity’s biggest challenge, ever. In the next decade, the green bond market can propel to a multi-trillion dollar market, and equip society with the much needed tools to address our changing global climate.

"lasting" - Google News

December 13, 2021 at 12:44PM

https://ift.tt/3ykIcW4

Green Bonds: Lasting Solutions For Climate Change - Visual Capitalist

"lasting" - Google News

https://ift.tt/2tpNDpA

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Green Bonds: Lasting Solutions For Climate Change - Visual Capitalist"

Post a Comment